GST Liability Calculator

Calculate Your GST Liability

Quick Takeaways

- All Australian businesses with a turnover over $75,000 must lodge a GST return each quarter (or annually if you qualify).

- Your GST return is filed through the Business Activity Statement (BAS) on the ATO’s online portal.

- Gather sales invoices, purchase receipts, and your GST ledger before you start.

- Complete the BAS, double‑check the totals, then submit and pay any GST owed by the due date.

- Watch out for common slip‑ups like forgetting to include GST on imported services or mis‑classifying exempt supplies.

Filing GST can feel like a maze, especially if it’s your first time handling a Business Activity Statement. This guide breaks the process down into bite‑size steps, shows you exactly what records you need, and highlights the traps that trip up most small‑business owners.

Goods and Services Tax (GST) is a value‑added tax of 10% applied to most goods, services and other items sold or consumed in Australia. It’s collected by registered businesses and passed on to the Australian Taxation Office (ATO). When you lodge your Business Activity Statement (BAS), you’re reporting the GST you’ve charged, the GST you’ve paid, and the net amount you owe or are owed.

Who Needs to Lodge a GST Return?

If your business’s turnover (gross income before expenses) regularly exceeds $75,000 a year, you must register for GST and lodge a return. The threshold drops to $75,000 for non‑profit organisations and stays the same for most sole traders.

Even if you’re below the threshold, you can choose to register voluntarily - that’s useful if you want to claim GST credits on big purchases.

How Often Do You File?

Most businesses report GST quarterly, which means you have four filing windows each financial year:

- July1-September30 (due byOctober28)

- October1-December31 (due byFebruary28)

- January1-March31 (due byMay28)

- April1-June30 (due byJuly28)

If your annual turnover is under $20million and you prefer a single return, you can apply to lodge annually. The ATO will then give you a different due‑date schedule.

What Records Do You Need?

Before you even open the BAS, collect these core documents:

- Sales invoices showing GST collected (the 10% amount).

- Purchase receipts or tax invoices that include GST you’ve paid.

- Your GST ledger - a spreadsheet or accounting software report that totals GST on sales and purchases.

- Your Australian Business Number (ABN) and Tax File Number (TFN).

- Any PAYG withholding statements if you’ve made employee payments.

If you use accounting software like Xero, QuickBooks, or MYOB, most of this data can be exported directly into a BAS‑ready format.

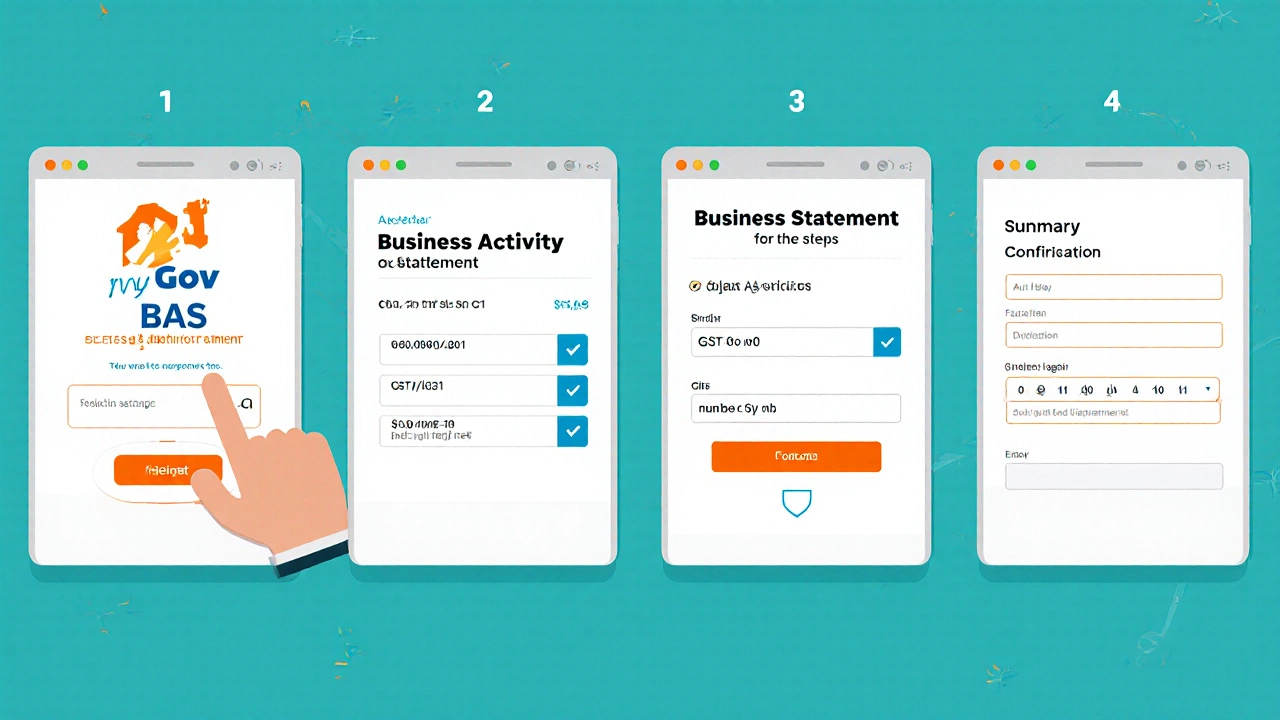

Step‑by‑Step: Completing the BAS

- Log in to myGov and connect to the ATO. If you haven’t linked the two, follow the on‑screen prompts - it takes about five minutes.

- Select “Business Activity Statement”. Choose the reporting period you’re working on.

- Enter your GST on sales (G1). Pull the total GST collected from your sales invoices or the GST column in your ledger.

- Enter GST on purchases (G11). This is the total GST you’re entitled to claim back. Double‑check that each purchase invoice includes a valid tax invoice (must show ABN, GST amount, and date).

- Calculate net GST payable. The system auto‑calculates G1 minus G11. If the result is negative, you have a GST refund.

- Fill in other sections. Even if you only deal with GST, you’ll still see fields for PAYG withholding (G2), fuel tax credits (G13), and others. If they don’t apply, leave them at zero.

- Review the summary. The BAS will show a total amount due. Compare it with your own spreadsheet to catch any mismatches.

- Submit the BAS. Click ‘Submit’ - the ATO will give you a confirmation number.

- Pay any GST owed. You can pay instantly via BPAY, credit card, or schedule a direct debit. If you have a refund, the ATO will process it within 10‑15 business days.

That’s the whole process - roughly 30minutes for a tidy record‑keeping system.

Common Mistakes and How to Dodge Them

- Missing tax invoices. A GST claim is rejected if you can’t produce a valid tax invoice. Keep digital copies in a dedicated folder.

- Including GST‑free supplies. Some items, like fresh food or education services, are GST‑free. Don’t add GST on those sales; it skews your G1 total.

- Forgetting imported services. If you bought a cloud subscription from overseas, you still owe GST under the “reverse charge” rule. Record it in G11.

- Late lodgment penalties. The ATO levies 1% of the GST amount due for each month you’re late, up to a maximum of 25%.

- Mixing personal and business expenses. Only business‑related GST is claimable. Separate your personal purchases to avoid audit flags.

Checklist Before You Hit Submit

| Item | Done? |

|---|---|

| All sales invoices for the period recorded | |

| All purchase tax invoices captured | |

| GST ledger totals match G1 and G11 | |

| Reverse‑charge GST on imports entered | |

| PAYG, fuel tax credits, other codes reviewed | |

| Payment method set up (BPAY/Direct Debit) |

What If You Miss a Deadline?

First, don’t panic. The ATO offers a “payment plan” option if you’re unable to pay the full amount immediately. Log in to your myGov account, select “Payment plans”, and follow the steps. You’ll still incur a penalty, but the interest charges are lower than a default debt notice.

If you realise you made a mistake after submission, you can lodge an amendment (an “adjusted BAS”) within 12 months. The same online portal lets you upload corrected figures and attach supporting documents.

Frequently Asked Questions

Do I need to lodge a BAS if I’m a freelancer with occasional sales?

If your annual turnover exceeds $75,000 you must register for GST and lodge a BAS, even if you’re a solo freelancer. Below that threshold, you can stay off the GST register and avoid BAS altogether.

Can I combine GST reporting with my PAYG instalments?

Yes. The BAS includes sections for both GST (G1, G11) and PAYG instalments (G2). You’ll fill out both in the same form and pay any amounts together.

What software integrates directly with the ATO’s BAS portal?

Xero, QuickBooks Online, and MYOB all have built‑in “BAS reporting” features that can push data straight to the ATO via the Standard Business Reporting (SBR) API.

How long does a GST refund take?

If you’re lodged electronically and there are no issues, refunds are usually processed within 10‑15 business days.

Is there a grace period for first‑time lodgers?

The ATO may waive the first‑time late‑lodgment penalty if you can show a genuine mistake, but it’s not automatic. Contact the ATO as soon as you spot the error.

Write a comment